salt tax cap news

52 rows The deduction has a cap of 5000 if your filing status is married filing. NBC News calls Democrat-backed SALT proposal set to help millionaires a middle class tax provision Data from the Tax Policy Center show the top 1 would benefit the most from the SALT proposal.

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

In the second of a two-part series Baker Botts William Gorrod Renn Neilson Matthew Larsen Jon Feldhammer and Ali Foyt share considerations for deciding whether to make the PTET election in a given state give an update on federal proposals to increase.

. Recap of the SALT Cap Workaround. SALT Cap Workaround. House Democrats on Friday passed their 175 trillion spending package with an increase for the limit on the federal deduction for state and local taxes known as SALT.

In the past year a multitude of states enacted pass-through entity tax PTET elections in response to the 10000 state and local tax SALT deduction limitation that the Tax Cuts and Jobs Act TCJA put in place. To help pay for that increase SALT deductions were capped at 10 000 per. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed.

But the cap is unpopular with. Bernie Sanders I-Vt Charles Schumer D-NY and Joe Manchin D-WVa Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate. Raising the SALT cap from 10000 to 80000 would almost exclusively benefit the highest 20 of tax filers who are households earning more than 175000 a year according to an analysis Thursday.

D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid a tax. Democrats from blue states such as New York and New Jersey have been pushing to include a rollback of the SALT deduction cap in the spending package though. 54 rows The Internal Revenue Service IRS has provided data on state and.

August 9 2021 1133 AM 3 min read. Pass-Through Entity Tax Update Part II. Republicans created a 10000 limit on the SALT deduction as part of their 2017 tax law in order to raise revenue to help offset tax cuts elsewhere in the law.

Biden did not propose a repeal of the 10000 SALT deduction cap which limits the amount of state and local taxes that can be deducted before paying federal taxes as part of his social spending. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. The 2017 tax law capped the amount of state and local tax or SALT deductions which had been unlimited to 10000.

In part one of a two-part series Baker Botts William Gorrod Renn Neilson Matthew Larsen Jon Feldhammer and Ali Foyt share how a. No SALT no deal they said. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over.

9 2022 145 AM. In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction. Representative Judy Chu a Democrat from California speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US.

As discussed in Part I of this article at least 22 states have adopted a pass-through entity taxor PTETelection for small business owner taxpayers seeking to avoid the 10000 federal deduction limit for state and local taxes. The SALT cap workaround was enacted in 2021 allowing entities taxed as S corporations or partnerships to elect to pay a 93 state income tax and their owners to claim a credit on their personal. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030.

Capitol in Washington DC on Thursday. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before dropping it back to 10000 in 2031. Most state PTET elections follow the standard workaround formula for the SALT cap which was introduced under the 2017 Tax.

However many filers dont know. 8 2022 145 AM. The relaxed cap an increase from the current 10000 limit would last for a decade until 2031.

Lost a legal challenge to a provision of the 2017 law that limited write-offs for state and local taxes as a federal judge threw out a lawsuit seeking to block the cap. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package. By James Bartek CPA and Jason Rosenberg CPA CGMA EA MST Withum December 2 2021.

The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act. The SALT deal appeared to remove one obstacle to passing the sprawling 19 trillion spending plan. Four states in the eastern US.

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Tax Giveaways To Millionaires Democrats Salt Plans Divide Party Financial Times

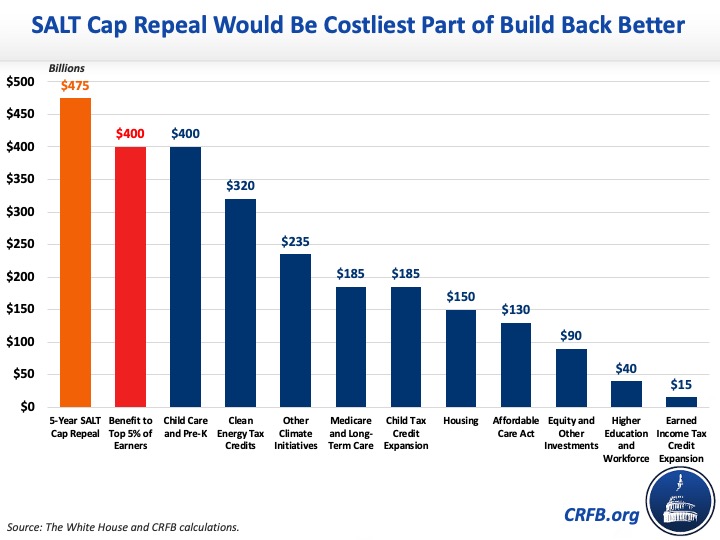

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Citizens Continue To Exit High Tax Us States In 2021 Income Tax Return Address Numbers Reconciliation

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It